Anatomia del corpo humano...

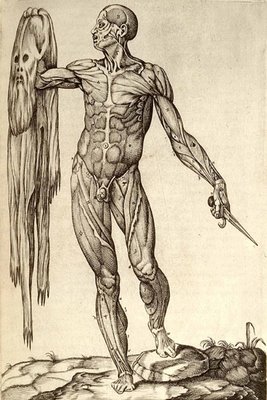

Rome, 1559. Copperplate engraving. National Library of Medicine.

Juan Valverde de Amusco

(ca. 1525 - ca. 1588)[anatomist]

A flayed cadaver holds his skin in one hand and a dissecting knife in the other. The skin’s distorted face has the appearance of a ghost or a cloud, suggesting that spirit has been separated from, or peeled off of, the fleshy inner man.

from here

There is something about the description above that reminds me both of the spiritless liturgy the passes for reporting, and of how people that fell for the hype and spin will feel when they start to realize negative equity, and their own credulousness. And just wait until they are hit by recession (part of the larger economic cycle).

Below I react to an article in The Sun -

The upside of British Columbia's real-estate-market cycle has been steep, but the downside will not be as rapid as in the U.S., according to the real estate firm Century 21 Canada.This is garble. They mention cycles, but don't seem to have seen VHB's graph, or any other of the like. They do not seem to be paying attention to their own numbers either, though I suppose that they just added some adjectives to the press release from the dispassionate Huge RE firm. It's reassuring to hear that our "downside" will not be as rapid as that to the south. I must have missed the news about the US market hitting bottom, and beginning to rise to new, record levels.

House prices in select B.C. markets have been flat or risen up to 12 per cent in the last year. That follows a much steeper rise of between 89 per cent and 114 per cent over the last five years, Century 21 reported Wednesday in its annual survey of house prices.Select BC markets hmm? Have "been flat or risen" (sic) - which is it ferfuxaches? I ought to have used the spin .gif for this post. It "follows a much steeper rise...the last five years", but if prices are flat, there is no more appreciation occuring, and if they are up 12%, that is still a considerable - if flagging - appreciation.

However, while the median U.S. house price dropped 11.5 per cent compared with a year ago, Century 21 Canada president Don Lawby said B.C.'s economy is strong enough and its real estate sector different enough to isolate the province from a similar decline.

Lawby, in an interview, said that while real estate sales have dropped, B.C.'s economy has grown more than the U.S. economy, and is spread across a more diverse base than has been the case in the past.

It doesn't much matter which way you cut with this knife, it still means the market is slowing markedly. And it's only beginning. China has been loading up on copper and other metals, so mining will likely slow. Lumber market already hurting in Ontario and Quebec - and likely in BC too, they just don't report on that. But don't you worry, everything will be ok. Just take this little pill. You did know that things are different here...right?

Just what is this greater economic diversity that we enjoy, that we had not before? Condo construction? The RAV Line? Highway construction? Five years of construction projects has added a great diversity? And since when has the BC economy been equatable with the US economy? Can we compare economies, but not market cycles?

Thanks to Derrick Penner and RET for the article, and the WTF? fuel for this post.

4 comments:

OT

Great illustration. If you visit the Body Worlds exhibit at Science World in Vancouver, you can see the real body holding its skin in the same way.

Never know the body might inspire some great understanding of the RE market.

The vancouver economy has grown faster than the US? I don't think so... In what terms.

The vancouver economy has grown faster than the US? I don't think so... In what terms.

Oh Doubting Thomas - er, michael. It must be so. I read it in the paper.

Drives me nuts. Sure, the economy is "strong" by certain indicators, but SFHs are, what, at 10 times median wage to median price? Retail workers cannot buy shitty condos even if the record employment levels allow them to have 2 jobs.

Economy being strong does NOT justify the entire market skewed to the high end, because strong economy has not meant that our wages have risen 20% YOY. Just plain stupid.

Post a Comment